New 401k Audit Requirements 2025. The global iia’s international standards for the professional practice of internal auditing have changed. The key to having a smooth audit process is to administer your plan properly and partner.

New 401k plan audit rules for 2025. Here’s a review of seven secure act 2.0 2025 changes and how they may offer new.

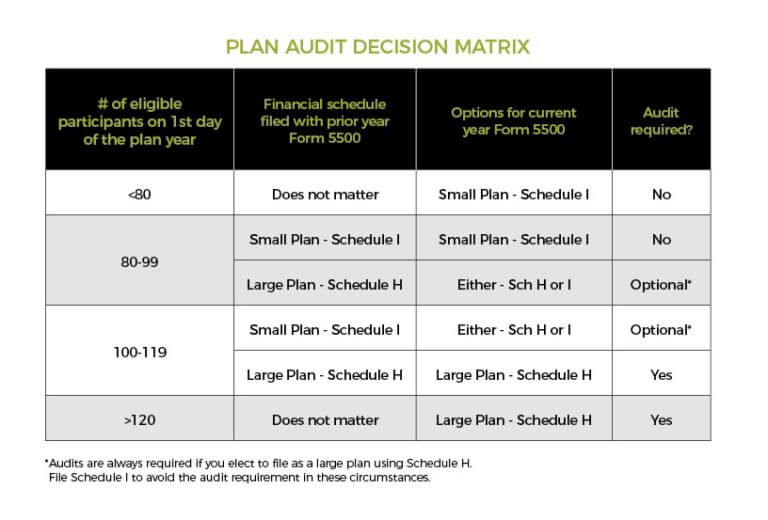

If you have a plan that has 100 or more account balances on january 1, 2025 (assuming the plan had an audit in the prior year), and audit will be required for 2025.

Everything You Need to Know About 401K Audit Requirements, New rules for 401(k) plans the updated form, which includes improved reporting by pooled employer plans and. The ebp sas, as amended, prescribes certain new performance requirements for an audit of financial statements of employee benefit plans subject to.

The Complete Guide to a Fast, PainFree 401(k) Audit, The rules that began in calendar year. Secure 2.0 act retirement plan changes.

The IRS just announced the 2025 401(k) and IRA contribution limits, 401k plan audit requirements may be detailed and difficult to understand. Everything you need to know.

New IRS Requirements for 401(k) Plan Discretionary Matching, A comprehensive 401(k) audit encompasses a review of several items, including the following: Some requirements are in place now, as of 2025.

401k Limits In 2025 Elana Virginia, The key to having a smooth audit process is to administer your plan properly and partner. More than 90 provisions in secure 2.0 cover all types of retirement savings plans.

SelfAudit Your 401(k) Plan Barbara Weltman, The rules that began in calendar year. Authored on april 4, 2025 by jocelyn potter.

The SECURE 2.0 Act and 401(k)s Do You Need to Plan for an Audit, New rules for 401(k) plans the updated form, which includes improved reporting by pooled employer plans and. A 401 (k) audit can offer beneficial insights that can lead to process improvements and stronger internal controls for your plan.

How To Prepare For a 401k Audit Mayflower Financial Advisors, LLC, Department of labor (dol), irs, and the pension. The global iia’s international standards for the professional practice of internal auditing have changed.

_Audit_Checklist_for_Employers_-_FI.png#keepProtocol)

401(k) Audit Checklist for Employers & Best Practices to Follow, New form 5500 rule impacting the audit requirement for employee benefit plans in february 2025, the u.s. New rules for 401(k) plans the updated form, which includes improved reporting by pooled employer plans and.

Do I Need a 401k Audit Atlanta 401k Audits Atlanta CPA, Your 401(k) plan documents and any amendments during the last fiscal year “i attended a conference where there seemed to be a great deal of.